nassau county tax rate calculator

The current total local sales tax rate in Nassau County NY is 8625. You can find more tax rates.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county.

. The sales tax rate does not vary based on location. The average cumulative sales tax rate between all of them is 863. Figuring the prorated tax for the buyers and sellers is a five-part process.

Nassau County collects on average 074 of a propertys. In imposing its tax rate the city is compelled to observe the New York Constitution. The December 2020 total local sales tax rate was also 8625.

The New York state sales tax rate is currently. The State of Delaware transfer tax rate is 250. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

Delaware DE Transfer Tax. The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

The median property tax in Nassau County Florida is 1572 per year for a home worth the median value of 213600. The most populous location in Nassau County Florida is Fernandina Beach. Nassau is located within Rensselaer.

Choose a tax districtcity from the drop-down box. To calculate your Nassau County property tax bill you will need to know your homes market value the level of assessment for the municipality or tax authority and the tax. A full list of these can be found below.

Nassau County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Nassau County totaling 1. This is the total of state and county sales tax rates. 74 rows The New York sales tax of 4 applies countywide.

For comparison the median home value in Nassau. Reasonable property worth appreciation will not increase your annual bill enough to justify a. As for zip codes there are around 88 of them.

The most populous location in Nassau County New York is Valley Stream. Some cities and local. Sales tax in Nassau County New York is currently 863.

Nassau County in New York has a tax rate of 863 for 2022 this includes the New York Sales Tax Rate of 4 and Local Sales Tax Rates in. Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. The sales tax rate for Nassau County was updated for the 2020 tax year this is the current sales tax rate we are using in.

Nassau County collects on average 179 of a propertys. This includes the rates on the state county city and special levels. Thoroughly calculate your actual tax using any exemptions that you are qualified to use.

The average cumulative sales tax rate in Nassau New York is 8. The most populous zip code in Nassau County New York is 11550. The average cumulative sales tax rate between all of them is 7.

In fact tax rates cant be increased before the general public is first notified of that aim. The minimum combined 2022 sales tax rate for Nassau County New York is. Nassau County Sales Tax Rates for 2022.

Nassau County Sales Tax Rates for 2022 Nassau County in New York has a tax rate of 863 for 2022 this includes the New York Sales Tax Rate of 4 and Local Sales Tax. Calculate the daily tax rate by dividing the annual tax rate by the days in the year 365 or 366 for leap years. A full list of these can be found below.

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Top Mortgage Broker In Upper Eastside Mortgage Loans Mortgage Brokers Refinance Mortgage

New York Property Tax Calculator Smartasset

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Lowest Highest Taxed States H R Block Blog

New York Property Tax Calculator Smartasset

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Asort Calculation System Train Goods And Service Tax

New York Property Tax Calculator Smartasset

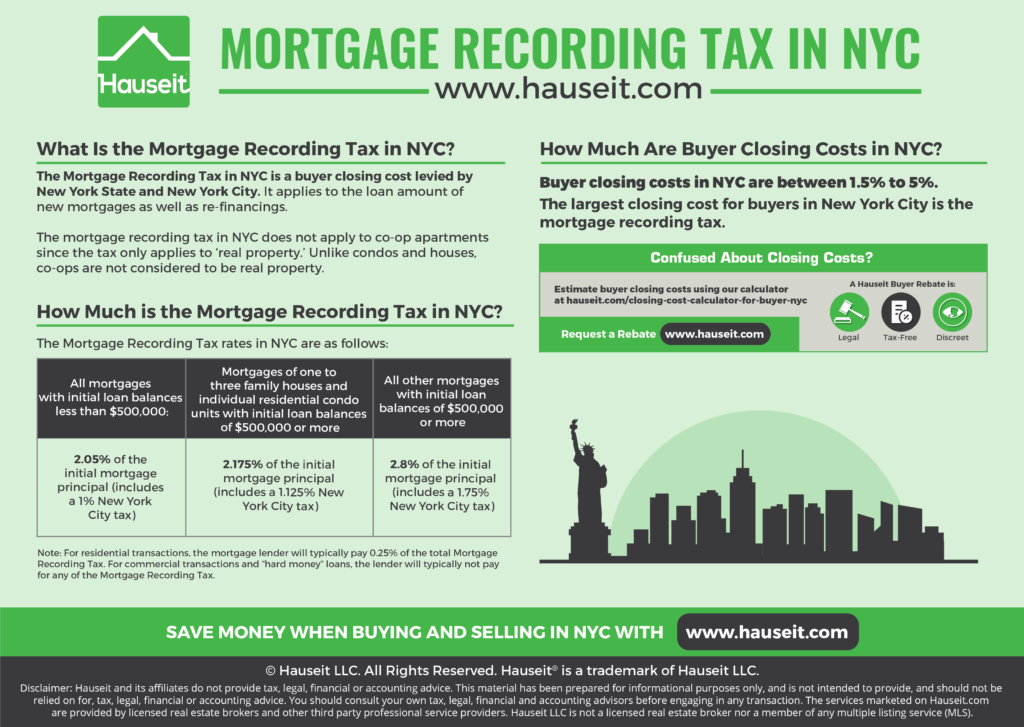

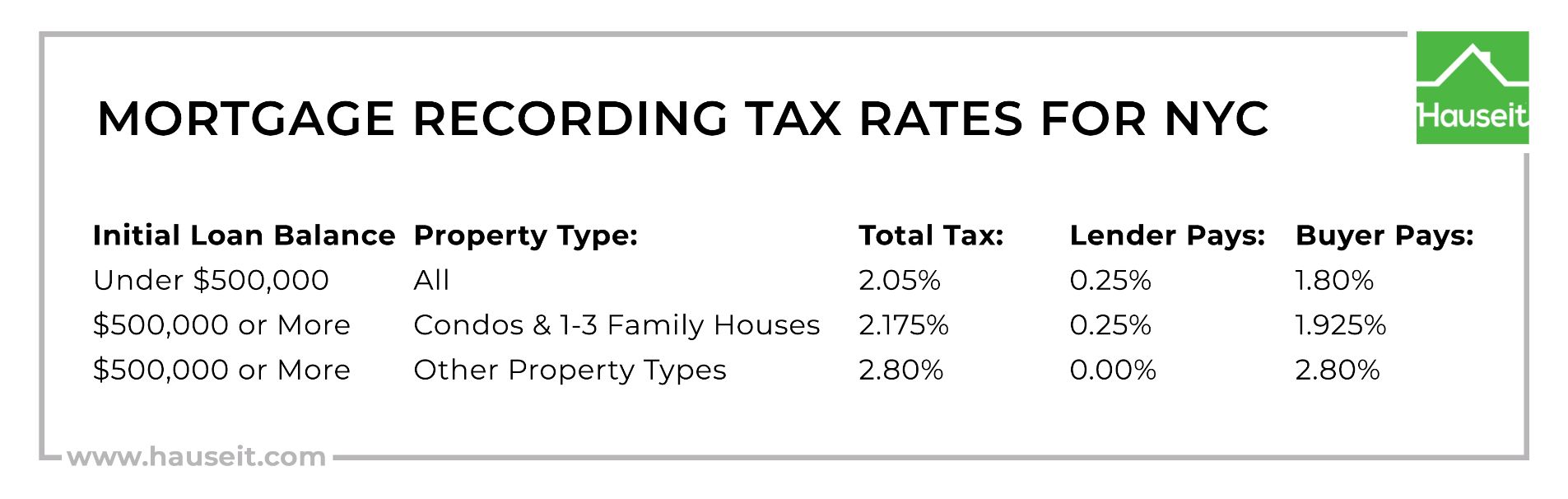

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Amendment To Tax Law Section 1404 A Regarding Calculation Of New York State Transfer Taxes Grossing Up World Wide Land Transfer

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit